IB Diploma Economics:

|

|

Economic growth and economic development – Topics:

|

Understanding Economic DevelopmentLearning outcomes for the Understanding Economic Development topic in the IB Economics course:

|

What is economic growth?

Economic growth is an increase in the amount of goods and services produced per head of the population over a period of time – i.e., increases over time in national output and the growth of national incomes. Standard measure of economic growth include the percentage increase in:

|

What is development?

Economic development is the efforts that seek to improve the economic well-being and quality of life for a community by creating and/or retaining jobs and supporting or growing incomes and the tax base – i.e., will improve the standards of living for the whole population.

Economic development is concerned with how increases in income and output can lead to better living conditions, better healthcare services and health outcomes, education and training, and working conditions (especially safety in the workplace and non-exploitative practices such as the use of child labour). The equitable distribution of wealth and income, equality of opportunity and the protection of human rights are all encompassed in measures of economic development, as too are the very basics of human welfare – the reduction of hunger and poverty and ensuring housing is adequate. Social welfare can be measured in many ways, and improvements in any of these areas increase human welfare. Thus, the economic development approach rejects that output and income are the only ways to measure living standards. |

Sources of economic growth in least developed countries

|

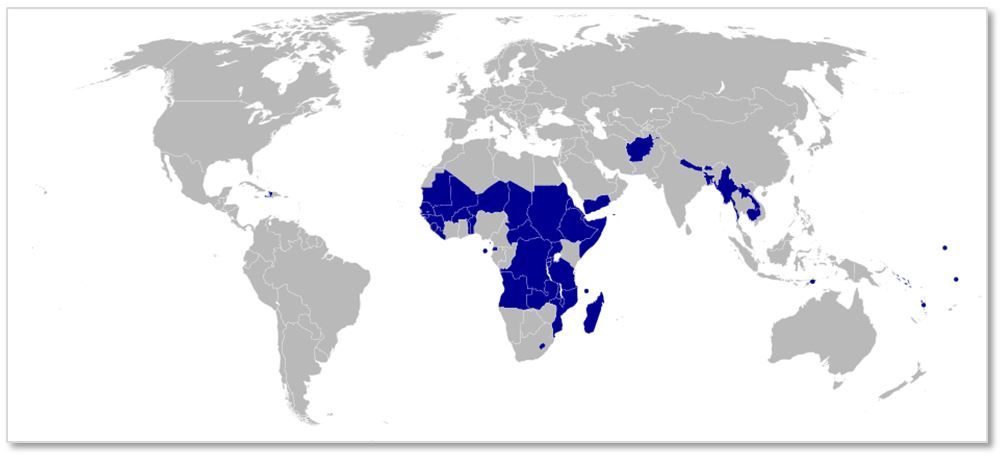

The least developed countries (LDCs) are a group of countries that have been classified by the UN as "least developed" in terms of their low gross national income (GNI), their weak human assets and their high degree of economic vulnerability.

A country will sustain long-term economic growth by increasing its productive capacity. The quantity and productivity of the factors of production (land, labour, capital and entrepreneurship) determine the level of potential output. It is unlikely that increased economic growth in LDCs will be achieved by increasing the amount of human capital available, and this is especially true of social welfare where scarce resources will be divided between more and more people. As the population of an LDC grows, nominal economic growth may follow in terms of increased GDP, but it is much more likely that real GDP per capita will decline, reducing average income. Rather, improvements in the productivity of human and physical capital should be the focus of economic growth, the quality of which must be improved to increase output and income per person. Education is key. Increasing a nation’s numeracy and literacy rates, and providing skills training are key steps to be taken to increasing the productivity of human capital. Healthcare, access to nutritious food, clean drinking water and good housing will increase the productivity of labour and boost a country’s potential output. The role of physical capital is important too. If a country can both increase the stock of capital goods it uses to produce goods and services, as well as improving the efficiency of such physical capital, then it will increase its productive capacity. Examples of physical capital include necessary infrastructure such as schools, hospitals, electricity and telecommunications networks, universities, roads, ports, railways and airports. The construction of commercial property, factories and residential housing are included here. As too are the capital goods, machinery and equipment, which will increase the capital intensity of an economy and increase the productivity of labour in the production of goods and services. However, this begs the question, where does an LDC source its needed investment capital from? LDCs are relatively poor, and as such these countries have a low marginal propensities to save and a high marginal propensity to consume. Average incomes are very low, and households will spend most of their incomes on necessities such as food and shelter, healthcare and transport to and from work. Low incomes do not really allow for any significant amount of savings in aggregate. |

Savings make it possible for entrepreneurs to make capital investments, and with only a small deposit base banks cannot make meaningful levels of business loans within the economy. Thus, there are relatively limited funds that are available for firms to invest in new capital goods and research and develop new technologies to increase productivity and drive economic growth. Foreign direct investment then becomes necessary for the capital intensification of an LDC’s economy.

Governments in LDCs are less able to make important investments in necessary infrastructure, which would improve productivity levels and increase potential output. There are two problems governments of LDCs face in financing such investment infrastructure, and both are caused by low tax revenues. The first issue is that because average incomes are low, so too are tax revenues. Secondly, LDCs will not have the systems in place to monitor economic activity and ensure compliance. It is difficult for an LDC to know who is making sales and how many sales are being made to collect sales taxes; who is being employed and how much they earn for income taxes; and which firms are operating and how profitable they are. Much economic activity takes place in the black market which, by definition, does not have any government oversight. Thus, the governments of LDCs have relatively limited finance available for investing in transport networks, hospitals and schools. Similarly, for sustained economic growth a country must have certain institutions in place, and for these to be functional. Political stability is important, because with increased certainty around the social and business environment, both local and foreign direct business investment will increase. The banking sector needs to be available and stable as to provide savers with interest on their deposits and to use as a source of investment funds. The government of an LDC must ensure that a functioning and enforceable legal system is in place. For business confidence and investment to improve, firms should have confidence that contracts and property rights can be enforced in a court of law. Corruption and bribery should be minimal. Essential statement: The growth of an economy depends largely on the quantity and productivity of a country’s factors of production, as well as a general environment where a country’s institutions provide confidence for investors. Too many resources?!

|

Economic development is somewhat dependent on economic growth

|

Economic growth leads to increased national income – real GDP per capita will increase. However, this where the distribution of national income becomes so important. Is economic growth benefiting a handful of the elite, or are more and better paying jobs distributing the share of increasing national income more widely within the economy? If economic growth benefits relatively few within an economy, then economic development will not follow and standards of living will not improve for the majority of people.

Economic growth should drive economic development in two ways:

|

Corruption and the misappropriation of revenues, spending on the military and vanity projects (e.g., building new stadiums) do little to improve economic development.

Economic growth has some negative impacts on welfare. Pollution, environmental degradation and urban congestion are all examples of negative externalities of production and consumption signalling market failure and the loss of welfare. The exploitation and intensive farming and harvesting of land and natural resources such as minerals and oil can lead to increased economic growth in the present, but will reduce the ability of future generations to benefit from these resources and maintain or increase their living standards. African economic development

|

Common characteristics of most LDCs

|

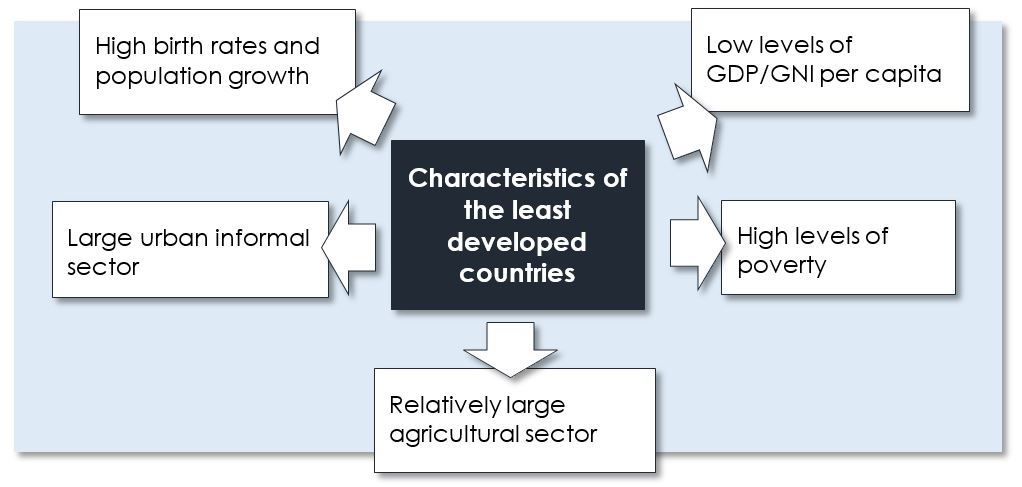

Figure 1 below illustrates the common characteristics of developing countries. In IB Economics it is very important to make clear that these characteristics do not apply uniformly to all LDCs.

Low levels of GDP/GNI per capita

Developing countries have low levels of GDP per capita. Gross Domestic Product (GDP) is the market value of all final goods and service produced in a country in a year, and GDP per capita is this income divided by the population of a country. Low average incomes means that most people living in LDCs such countries are relatively poor, and often have a sizeable proportion of their populations living in absolute poverty.

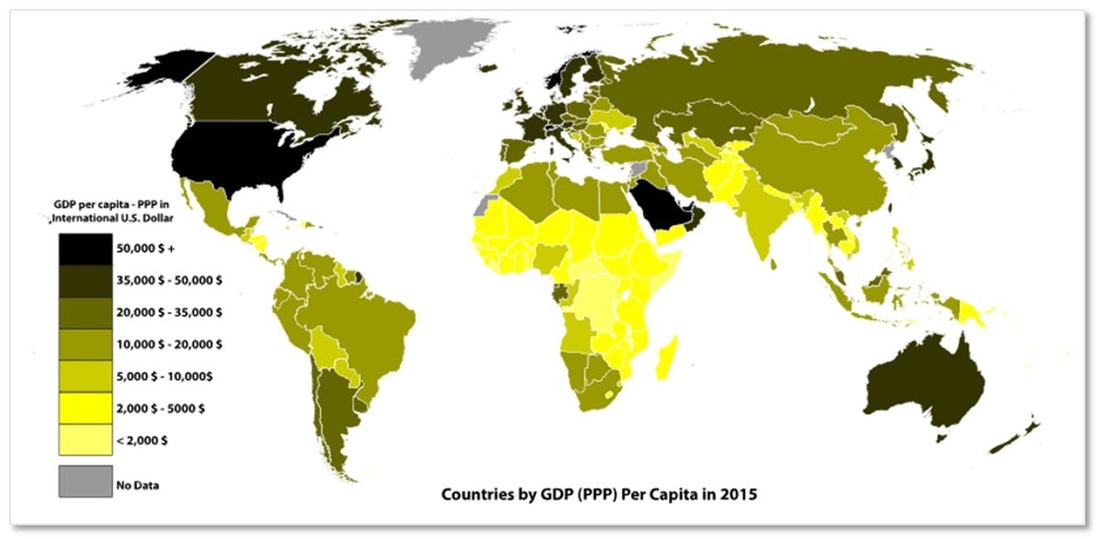

Labour productivity will be low because investment in infrastructure and capital goods is also low. Low output per unit of labour weighs down on average incomes. Some countries do relatively well on the GDP per capita index but perform poorly in terms of economic development. This is the case when national income is high, but income distribution is very unequal. For example, some countries have good oil and mineral resources owned by the state and/or corrupt firms which siphon off profits to the massive benefit of a few elite. Figure: Countries by GDP per capita.

large agricultural sectors

An underdeveloped economy is predominantly an agrarian economy. Predominance of agriculture is viewed from two angles – first is the contribution of this sector towards national income. In LDCs, agriculture contributes roughly 30-50 per cent towards national income. On the other hand, in developed countries, agriculture occupies a secondary position since 2 to 8 per cent of national income comes from this sector.

Secondly, LDCs mainly depend upon agriculture and extractive industries like mining, fisheries and forests. This means that the bulk of the population is engaged in agriculture and allied pursuits. About 55-75 per cent of the population are engaged in agriculture. Only 10 per cent are employed in the secondary sector, and the rest in the tertiary sector. In advanced countries, agriculture provides employment to a small fraction of the people (2 to 5 per cent). To compound matter, the agricultural sectors of LDCs will be characterised by low levels of productivity. Farms will be smaller and use less capital equipment than agriculture in developed economies. Thus agriculture in LDCs is highly labour intensive whereas in developed economies it tends to be highly capital intensive. High population growth

Most LDCs are experiencing rapid population growth. Most LDCs are in a stage of demographic transition. This means that they have falling death rates, due to improving health care, while birth rates remain high. The recent history of population management policies in China illustrates population-change management problems.

Causes of population growth in LDCs include limited access to family planning services and education about contraception. Contraception and other methods of family planning may not be culturally or religiously acceptable. Further, children may be seen as a valuable source of labour and income for a family. They can work on the land from a young age and as they get older they can earn money in other jobs. Children can also help to care for younger children and elderly family members. High rates of infant mortality (infant deaths) mean that women need to have many children in order to ensure that some survive through to adulthood. It may be traditional or culturally important to have a large family. LDCs have a high population-growth rate which means that they have many young dependants. Governments in LDCs and international bodies and charities are working to reduce birth rates and slow down rates of population growth. Youthful populations. The high birth rate in LDCs results in a high proportion of the population under 15. This youthful population gives a country specific problems, including:

The world's informal sectors

|

The world's least developed countries.

High levels of povertyHigh levels of poverty abound in LDCs which, of course, is related to low GDP per capita. Absolute poverty is a condition characterised by severe deprivation of basic human needs, including food, safe drinking water, sanitation facilities, health, shelter, education and information. It depends not only on income but also on access to services.

Low levels of income means that individuals cannot afford the basic necessities, let alone services such as health care and education. As a result, malnourishment and ill health may be endemic in the population, and high infant and child mortality and low literacy rates are often prevalent. Low incomes mean low government revenues which, in turn, lead to low investment in services such as social housing, education and healthcare which increase economic development. Large urban informal sector

The formal sector of an economy is legally regulated, the informal sector is not. Activities occurring within the informal sector will be unregistered and unregulated. Even developed countries have their informal sectors (e.g., cash payments for haircuts or unregulated building activity), but are much more important in LDCs.

The informal economy refers to activities and income that are partially or fully outside government regulation, taxation, and observation. The main attraction of the undeclared economy is financial. This type of activity allows employers, paid employees, and the self-employed to increase their take-home earnings or reduce their costs by evading taxation and social contributions. On the one hand, informal employment can provide a cushion for workers who cannot find a job in the formal sector. But, on the other hand, it entails a loss in budget revenues by reducing taxes and social security contributions paid and therefore the availability of funds to improve infrastructure and other public goods and services. It invariably leads to a high tax burden on registered firms and employees. A high level of informality also can undermine the rule of law and governance. The fact that a large share of the population is openly ignoring laws, regulations and taxes can weaken the respect citizens have for the state. The informal sector is a pervasive and persistent economic feature of most LDCs, contributing significantly to employment creation, production, and income generation. Recent estimates of the size of the informal sector in developing countries in terms of its share of non-agricultural employment range roughly between one-fifth and four-fifths. In terms of its contribution to GDP, the informal sector accounts for between 25% and 40% of annual output in developing countries in Asia and Africa. There are various reasons why governments may be concerned about large informal sectors. These include potentially negative consequences for competitiveness and growth, incomplete coverage of formal social programs, undermining social cohesion and law and order, and fiscal losses due to undeclared economic activity. For most governments, these concerns outweigh any advantages that the informal sector offers as a source of job creation and as a safety net for the poor. An Insight into an Indian Slum

|

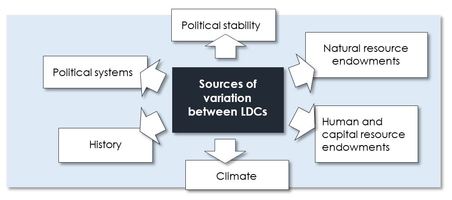

Diversity among economically less developed countries

|

Resource endowments in Chad

Natural Resource endowmentsNatural resources can be exploited to generate income. Some LDCs are relatively fortunate to have large oil and gas reserves (e.g., Angola), others have marketable minerals (e.g., diamonds in Botswana), and some LDCs have no such natural resources.

Some developing countries will have forests (e.g., Myanmar), fertile land (e.g., Kenya) or relatively large coastlines for fishing (e.g., the Philippines), while others will be dry and arid (e.g., Libya) and/or landlocked (e.g., Chad) Climate

In general, most developed economies have temperate climates and almost all LDCs have tropical and subtropical climates. Climate is thought to have be one of the different factors that can affect the level of economic development.

Climate is an important factor in determining the types and nature of economic activity that occurs within economies. Climate will affect what type of agricultural production can take place and it can also affect the productivity of labour. For example, it is difficult to work outside in the monsoon season in India, the Siberian winter or Yemeni summer. Soil quality is lower in tropical and subtropical climates, than more temperate climates. History

Certain historic events have had a long-term impact on economic development. For example, colonial rule affected the subsequent development of domestic institutions and economic development. Examples include the importance of colonial land revenue systems within India, and that Africa’s slave trade adversely affected subsequent development. Systems of colonial rule were based on an economic model to transfer resource wealth from the colonised to the colonisers, rather than to encourage economic development.

Political system

A political system is a coordinated set of principles, laws, ideas, and procedures relating to a particular form of government, or the form of government itself. Essentially it is how the government is structured and functions. For example, democracy is a political system in which citizens govern themselves.

Political systems and institutions are extremely important for economic growth in low-income countries. Specifically, the longer the same elite is in power, the more fragmented the party system is; and the greater the number of parties in the governing coalition, and the more party-centred the electoral system is, the smaller economic growth will be for low-income countries. On the other hand, the greater the district magnitude and the more choice within the electoral system, political polarisation and federalism help poor countries to achieve better economic performance. There are the odd exceptions. Modern Korea shows that dictators may be able to bring about economic development – but only to a point. Then political openness becomes crucial to keep that growth and development story going. Korea therefore provides important lessons for the rest of the emerging world, especially China. Political instability in Senegal

|

Sources of variation between LDCs

Human and capital resources

Some LDCs are investing heavily in education to boost literacy, numeracy and skills among the general population, and children and adolescents specifically. Education leads to the increased productivity of labour and boosts the level of entrepreneurship within an economy.

Many countries have committed themselves to more than the achievement of universal primary education and now include several years of secondary school in their national targets. Globally, 83 per cent of lower secondary-school-age children are in either primary or secondary school, dropping to less than 70 per cent in low-income countries. From 2000 to 2013, the number of out-of-school children of lower secondary school age shrank from 97 million to 65 million. But progress has slowed since 2007. Challenges to secondary-school participation are greatest in sub-Saharan Africa and South Asia. There are variations between LDCs in the number of girls in education and the workforce. For example, Morocco has relatively few girls in school as a proportion of the population compared to neighbouring Libya. There is also considerable variation between the performance or how much value-added comes from education between LDCs. In Vietnam less than 10 per cent of 15-year-old students failed to achieve even a minimum proficiency in mathematics, whereas in Columbia it is more than 70 per cent. Political stability

Political stability is the durability and integrity of a current government regime. This is determined based on the amount of violence and terrorism expressed in the nation and by citizens associated with the state. Generally, the more politically stable a country is, the greater the level of economic development. There are obvious exceptions, three generations of Kim have ruled North Korea since 1948 but their 70 years of stable rule has not led to any significant economic development.

The main reasons that political stability tends to generate higher levels of economic growth and development include:

Crazy like a fox? Maybe, but politically stable.

|

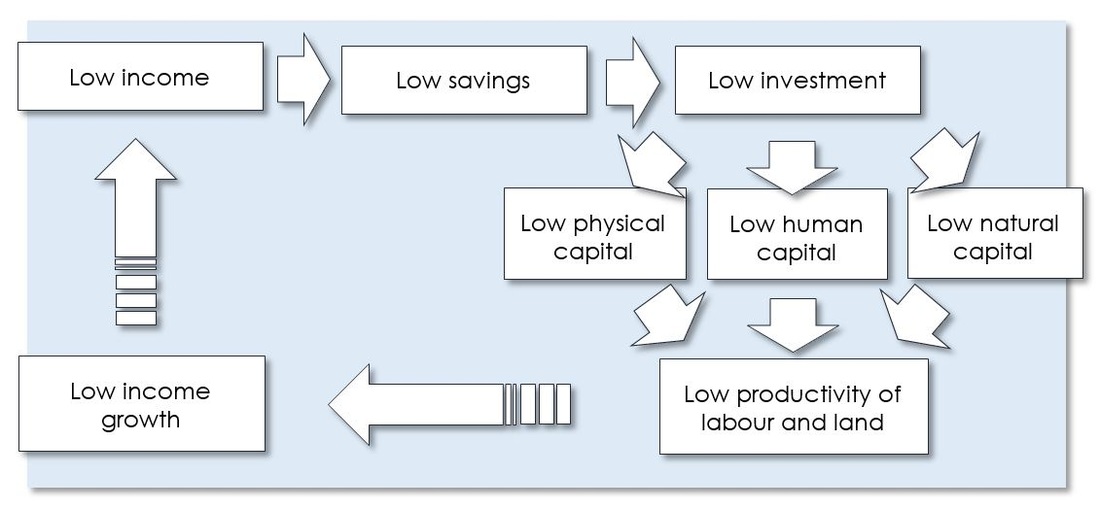

The poverty cycle (trap)Households spend all of their income when their incomes are very low. LDCs are relatively poor, and as such these countries have a low marginal propensities to save and a high marginal propensity to consume. Average incomes are very low, and households will spend most of their incomes on necessities such as food and shelter, healthcare and transport to and from work. Low incomes do not really allow for any significant amount of savings in aggregate. Without savings there are no funds to finance investments in both physical (e.g., capital goods) and human capital (e.g., education) which are both necessary to increase the productivity of labour and land. Thus, productivity increases only incrementally over time. Investment is required to achieve economic growth, and without economic growth incomes will stay low. With low incomes and low spending by firms and households, direct and indirect government tax revenues will remain low. With only low tax revenues, governments will find it very difficult to finance the necessary infrastructure and services spending (education, health transport networks, etc.) that would increase national productivity.

|

Figure: The poverty cycle

A country that is very poor is not able to save and, therefore, there are few funds available for investment in human capital and physical capital – because there is little investment productivity changes very slowly. Investment is needed for economic growth, without it the economy cannot grow and incomes remain low. Income and expenditure are low, therefore direct tax and indirect tax revenue is low. The government has very little money to invest in infrastructure and with low levels of investment in infrastructure productivity remains low. Thus, the only way to break out of the poverty cycle is by foreign direct investment, otherwise, generation after generation could be stuck in the poverty trap.

Essential statement: Low GDP per capita means that national incomes are too low to generate the savings needed to generate the private and public investment needed to increase productivity rates. And, without increased productivity, national income will remain low. The only way for an LDC to break out of the poverty trap is by attracting foreign direct investment. |

IB Economics 4.1 Economic Growth and Development

Summary Notes

IB Economics - 4.1 Economic Growth and Development teaching and learning PowerPoint notes for HL and SL IB Diploma Economics.

IB Economics 4.1 Economic Growth and Development Video Tutorial

PROGRESS CHECK - TEST YOUR UNDERSTANDING BY COMPLETING THE ACTIVITIES BELOW

You have below, a range of practice activities, flash cards, exam practice questions and an online interactive self test to ensure you have complete mastery of the IB Economics requirements for the Development Economics – Understanding Economic Development: 4.1 Economic Growth and Development topic.

IB Economics interactive QUIZZES AND TWO CLASSROOM GAMES

|

Test how well you know the IB Economics Understanding Economic Development: 4.1 Economic Growth and Development topic with the interactive self-assessment quizzes below. Aim for a score of at least 80 per cent.

|